This guide provides a step-by-step process for navigating Fannie Mae's cash-out refinance seasoning requirements. Understanding these rules is crucial for successfully accessing your home equity.

What is Fannie Mae Cash-Out Seasoning?

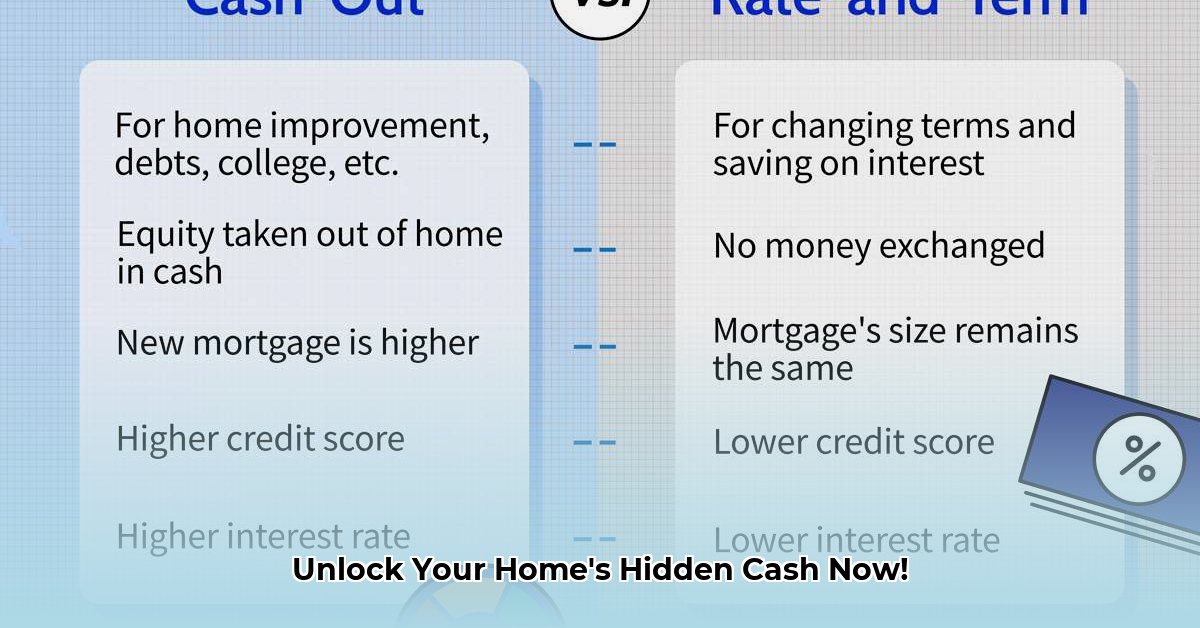

"Seasoning" refers to the minimum time your existing mortgage must be active before you can refinance it for cash. Fannie Mae uses this to assess your repayment history and risk profile. It's a crucial element in determining your eligibility for a cash-out refinance.

Essential Requirements for Your Cash-Out Refinance

Before applying, ensure you meet these key requirements:

- Mortgage Age: Your current mortgage generally needs to be at least one year old (12 consecutive months of on-time payments). This demonstrates consistent repayment ability.

- Homeownership: You typically need to have owned your home for at least six months. Exceptions exist for inherited properties or those acquired through legal settlements—requiring thorough documentation.

- Credit Score: A strong credit score significantly improves your chances of approval. Lenders use this to gauge your creditworthiness.

- Loan-to-Value (LTV) Ratio: This is the percentage of your home's value you're borrowing. A lower LTV reduces risk for lenders and increases your approval odds. Fannie Mae sets specific LTV limits for cash-out refinances.

- Intended Use of Funds: Fannie Mae scrutinizes how you plan to use the cash. Acceptable uses usually include home improvements, debt consolidation (excluding high-risk debts like payday loans), and education expenses. Using the funds for certain purposes, like paying overdue taxes or specific land contracts, may be prohibited.

- Documentation: Be prepared to provide comprehensive documentation, including proof of income, employment, and intended use of funds. Organized paperwork streamlines the process.

Understanding Fannie Mae's Cash-Out Refinance Process

This section details the step-by-step process of obtaining a Fannie Mae cash-out refinance:

- Check Your Eligibility: Begin by verifying that you meet the basic requirements. A pre-qualification from a lender can offer valuable insight. Will I meet the basic seasoning requirements?

- Gather Your Documents: Compile all necessary documentation proactively. This includes tax returns, pay stubs, bank statements, and identification. What specific documentation does my lender require?

- Find a Lender: Choose a lender familiar with Fannie Mae guidelines and the cash-out refinance process. They can guide you effectively. How can I find a lender experienced with Fannie Mae requirements?

- Submit Your Application: Submit your application. Many lenders offer online application systems, providing convenient progress tracking. What is the application process like for my chosen lender?

- Underwriting Review: This stage involves a thorough review of your application and supporting documents by both your lender and Fannie Mae's underwriting system (often DU – Desktop Underwriter) and possibly a manual review. This is where the seasoning requirements are rigorously checked. How long will the underwriting process take?

- Closing: Once approved, proceed with the final closing procedures to finalize your refinance.

Navigating Fannie Mae Cash-Out Refinance Exceptions

While the general seasoning requirement is 12 months, exceptions exist. Understanding how to navigate these exceptions is crucial.

- Identify the Exception: Determine why your situation doesn't meet the standard seasoning. This could involve inherited property, recent purchase (less than 12 months), or other unique circumstances. Thorough documentation is vital.

- Gather Documentation: Compile all relevant supporting documents (e.g., inheritance papers, court orders). The more comprehensive the documentation, the stronger your case.

- Consult a Lender: Seek guidance from a mortgage professional experienced with Fannie Mae exceptions. Their expertise significantly improves your chances of success.

- Complete the Application: Submit a detailed application with all supporting documentation. Accuracy is paramount.

- Underwriting Review: Prepare for detailed review. Be ready to answer questions clarifying any aspect of your application.

Potential Challenges and Mitigation Strategies

The following table outlines potential challenges and effective solutions:

| Challenge | Solutions |

|---|---|

| Insufficient Seasoning | Wait until your mortgage meets the 12-month requirement. |

| Low Credit Score | Improve your credit score before applying. |

| High LTV | Reduce debt, increase savings, or consider a smaller cash-out amount. |

| Inappropriate Use of Funds | Re-evaluate your intended use of funds, ensuring alignment with Fannie Mae guidelines. |

| Missing Documentation | Gather all required documents before applying. |

Key Considerations

- Prohibited Practices: Avoid practices that could be interpreted as circumventing Fannie Mae's guidelines. This can lead to penalties.

- Acceptable Uses of Funds: Clearly define how you plan to use the cash-out proceeds, ensuring they align with Fannie Mae's acceptable uses.

- LTV and DTI Ratios: These ratios significantly impact your eligibility. Maintaining favorable ratios increases your approval likelihood.

- Accurate Documentation: Thorough, accurate documentation remains the cornerstone of a successful application.

Remember, careful planning, complete documentation, and expert advice from a reputable lender are essential for a smooth and successful Fannie Mae cash-out refinance. Always refer to the most up-to-date Fannie Mae guidelines for the most accurate information.